Are you looking for a reliable and efficient solution for your organization’s accounting needs? Look no further than society accounting software! This software offers a comprehensive set of features that can make accounting and financial tasks easier and more streamlined. We’ll explore the features of this software, and how it can help you better manage your organization’s finances.

What is society accounting software and its purpose

Society accounting software is a special program designed for use by non-profit organizations. It is a powerful tool for the accurate recording, tracking and managing of the financial operations of a society. The software specifically caters to the needs of societies and their internal accounting cycles, offering features such as comprehensive society records, financial statement generation, and other advanced features for all types of societies.

The purpose of Cooperative housing society accounting software is to streamline the process of recording and tracking all financial transactions associated with a society. This helps to ensure that all transactions are accurately recorded and reported in one place, simplifying the recording and reporting of financial activities. This type of software also allows societies to easily monitor their financial performance and transactions. Which helps to minimize errors and prevent fraud. With the ability to easily generate financial statements and reports, societies are able to maintain accurate financial records and ensure the accuracy of their financial reports.

Overall, society accounting software provides a valuable tool for societies to ensure accurate records of their finances and to easily monitor their financial performance. It can help to make managing and tracking financial activities much easier and simpler, while also significantly reducing fraud and errors. In addition, it provides an efficient way to generate financial statements and reports, ensuring the accuracy and integrity of the financial statements. This powerful tool can help to make a society’s financial operations more efficient and cost-effective.

What features does society accounting software provide?

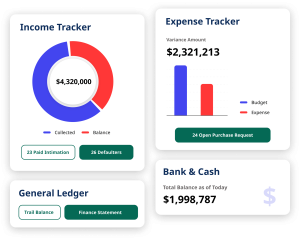

Society accounting software is a powerful tool for managing and analysing financial records and preparing statements. It provides many features to help organisations track and report finances. For example, it can keep track of bank accounts and investments, calculate taxes, process and record payments, reconcile accounts, and generate reports. It can also integrate with other financial systems and provide precise financial reports. Further, it enables multiple users to access different sections of a financial database and provides detailed statistics and financial insights.

Society accounting software can also provide automated payment notifications, automated credit/debit memos, and automated financial reconciliations. In addition, it includes tools for asset management, budgeting, and forecasting. With these features, society accounting software is an invaluable tool for staying on top of financial statements and records.

Advantages of using society accounting software

Today, society accounting software is quickly becoming an essential tool for all organizations and individuals. The various advantages of society accounting software make it more beneficial for users. For one thing, society accounting software simplifies the tedious tasks of recording and tracking transactions. It also provides users with helpful reports and insights that help them better understand the financial landscape of their organization. Additionally, society accounting software can help identify errors and discrepancies in financial information, making it easier to make informed and accurate decisions.

Furthermore, by automating tasks such as accounts receivable, accounts payable and payroll, society accounting software helps organizations far more efficiently manage and distribute information. This not only makes the reconciliation process much faster, but also reduces the chances of errors occurring. Finally, using society accounting software also allows organizations to easily store and share financial information with multiple stakeholders, allowing for quicker decision-making and better collaboration. With all these advantages and many more, it’s no wonder why society accounting software is becoming an increasingly popular option for organizations and individuals alike.

Types of society accounting & billing software available

For organizations that are looking to keep track of their financial data, selecting the right type of accounting software is essential. There are a variety of types of society accounting software available, each offering its own unique advantages and potential drawbacks. Organizations should carefully weigh the pros and cons of each type of software in order to make the best choice for their particular needs.

One of the most popular types of accounting software is cloud-based systems. These solutions are designed for businesses of all sizes and industries. Cloud-based solutions allow organizations to access their financial information from any device with an internet connection. This allows for easy collaboration, flexible pricing structures, and efficient data management. Additionally, cloud-based solutions are often scalable, meaning that additional features and user licenses can be added or removed from the system as needed.

Society accounting software is desktop accounting

Another popular type of society accounting software is desktop accounting. This type of software is designed for larger organizations, as it can be more expensive and difficult to use than cloud-based solutions. Desktop accounting software is installed on a single computer and is used on that computer alone. It offers the most flexibility in terms of customization and data control. Because the software runs directly on a computer, it can be used offline, making it ideal for those who have limited internet access or travel frequently.

Finally, there is mobile accounting software, which is designed to be used on smartphones and tablets. This type of accounting software is perfect for those who need to access their financial information while they’re on the go. Mobile accounting software is often more limited in terms of customization and functionality, but it is great for basic data entry and tracking expenses. Additionally, mobile accounting software is generally less expensive than other types and can be set up quickly and easily.

Regardless of the type of software chosen, organizations should be sure to consider their particular needs and analyze the features and benefits of each to ensure that they are selecting the best society accounting solution for their needs.

How to choose the right society accounting software for your organization

Choosing the right society accounting software for your organization is an important decision, and not one to be taken lightly. After all, it is the system that will help you manage your finances and keep your accounts in order. Luckily, there are a number of features to consider when selecting the accounting software that is right for you.

First and foremost, you need to decide what type of software you need. If your organization is very small and limited, then a basic software product may be sufficient. On the other hand, if you need more specialized features, then you will need a more advanced system. Additionally, you should consider the reporting capabilities, the customer service and technical support you will receive, and the ease of use of the system.

The next step is to research available products. Look at customer reviews and ratings, and compare prices and features. Consider the portability of the software; you may want to access it from any device and not just your desktop. In addition, ask about the compatibility and integration with other software or services. Finally, consider viewing a demonstration of the program before making your final decision.

Keep in mind that when selecting the right society accounting software for your organization, you want to be sure that it will meet all of your needs, including keeping up with industry standards and regulations. With the right software product, you can streamline your accounts, properly manage your financial records, and build a solid foundation for the financial success of your organization.

Choose the right accounting software

Choosing the right accounting software for your business can be an overwhelming task. With the wide range of options available, it can be difficult to narrow it down to one that makes sense for your company. It’s important to consider the features available, the required setup time and effort, as well as the cost of the program. One popular choice is a society accounting software program: a specialized program designed to manage the finances of a society or non-profit organization. Society accounting software can greatly simplify the accounting and reporting processes and can be a valuable tool for helping a society or non-profit successfully manage their finances.

When considering a society accounting software program, it is important to understand what type of features you need, and to ensure that the program you choose fulfills all of your society’s requirements. Different programs offer different features, and it is essential to ensure that the program you select will allow you to easily manage and analyse the data associated with your society’s finances.

The price of a society accounting software program can vary widely, depending on the particular features it offers. Some programs provide a basic package for a minimal cost, while more sophisticated and comprehensive programs will have a higher price tag. Additionally, many programs have additional “per-user” or monthly fees that may apply. It is important to carefully evaluate the cost benefits of the program you are considering, as well as the amount of setup time and effort required to get the program running. This can help you ensure that the society accounting software you select is the best fit for your society’s budget and needs.

How to set up society accounting software and common mistakes to avoid

Setting up a society accounting software solution is a great way to manage your organization’s financial activities. However, there are several key considerations to keep in mind when doing so. First of all, you need to ensure the software you are selecting is suited for existing regulations and standards in your jurisdiction. Next, be sure to investigate whether or not the software can handle the volume of transactions you expect to generate. Additionally, make sure that the reporting mechanisms and analytic capabilities are up to par with your needs. Finally, it is important to compare the software’s pricing and features against what competitors are offering.

When it comes to common mistakes to avoid, the most important thing is to remember to be incredibly thorough when assessing software. Read all documentation and tutorials carefully and make sure you understand the options and the implications of what they offer. Additionally, remember to management with user privileges, so that only certain users have access to certain tools. Failure to do this can lead to security issues. Additionally, regularly back up data, as this can help preserve financial information in the event of a system or hardware failure. Lastly, as you become more experienced with the software, remember to keep up to date with any changes or updates, as these may have a large impact on the way you operate.

Tips to ensure your society accounting software works efficiently

When it comes to managing the day to day operations of a society, accounting software can play a vital role in keeping track of finances and ensuring that any expenditure is properly monitored and accounted for. However, if you want to ensure that your society accounting software works efficiently, there are a few key tips to keep in mind.

First and foremost, you should always ensure your software is up to date. By using the latest version of the software, you can avoid any technical glitches and ensure its optimal performance. Additionally, you should also make sure that you regularly archive old files as well as back up any important data on a regular basis. This allows you to retain any records you may need in the future in a secure location.

In addition to keeping your software up-to-date, it is imperative that you understand how to use it effectively. For example, many organisations use the software to complete their bookkeeping tasks, such as recording expenses, balancing accounts and reconciling discrepancies. Therefore, it’s important to understand all the different functions that the software offers and how to complete each task accurately.

Society accounting software is desktop accounting

David Walsh, a chartered accountant for Blake Bush & Co, suggests that society members get together with their accountant to set-up the software as it can be time-consuming. At this stage, it is also possible to discuss any changes you may need to make in the system to monitor any anomalies.

Finally, it’s essential to have a clear understanding about who will be using the software and what the access control will look like. If there are multiple users, then it is important to ensure that each user has appropriate access to ensure everyone can use the system with the data security in mind. Additionally, when setting-up the software, you should also define the particular access levels and permissions, as this will help to ensure that all data remains secure.

By following these tips and making sure your society accounting software is up-to-date and secure, you can ensure that all of your accounts remain as accurate and as detailed as possible.

Security and privacy considerations when using society accounting software

When using society accounting software, security and privacy considerations should always be taken into account. It is essential to ensure that all financial information is secure and confidential, as this is crucial for businesses of all sizes. All users should take the necessary steps to ensure that the data is protected from any type of unauthorized access.

This may include setting up authentication mechanisms to ensure that only authorized personnel have access to the system and defining specific access rights for different users. It is also important to ensure that the software is updated regularly to eliminate any vulnerabilities. Furthermore, the system should be regularly monitored to detect any suspicious activity. Additionally, the privacy of the customer’s data should also be protected. This includes protecting data from any type of forwarding, disclosure, or modification. Safe storage, encryption, or tokenization of data should also be applied to ensure complete privacy. Adhering to these security and privacy considerations is essential for the successful implementation of society accounting software.

Best practices for using society accounting software

Using accounting software for a society can be a great way to streamline activities, save time, and simplify reporting and financial issue management. When used effectively, the use of accounting software can improve a society’s overall financial operations and save resources. To ensure that the software is effectively used, there are a few best practices that should be followed.

First, it is important to select the proper accounting software for the society. Different software programs may have different accounting features and capabilities and it is important to choose the one that will best fulfill the society’s needs. Once the proper software is chosen, it is important to ensure that the software is properly installed and configured. It is also essential to train all users on how to use the accounting software. Additionally, it is important to ensure that there is an up-to-date backup on hand in case of any problems during the operation.

Finally, it is important to maintain the software and update it regularly in order to prevent any issues from arising. The software may need to be updated to keep up with new accounting standards or to take advantage of new features and capabilities. Updating the software on a regular basis will help to ensure that the society is able to take advantage of the latest technology and maintain its financial health. Following these best practices can help to ensure that accounting software is used effectively and efficiently in a society.

Top society accounting software

Finding the right accounting software for your society is no easy task, with the vast number of products available on the market. To make matters easier, we have put together a list of the top 10 accounting software that are designed specifically for societies.

First on the list is ADDABooks.

ADDABooks is an absolute favorite among societies due to its ease of use and intuitive interface. It allows users to easily manage income and expenses, and track payments, while offering a secure online connection to manage financial information. Additionally, ADDABooks offers tons of useful business tools like invoicing and reports that make tracking finances easier than ever. Read more about ADDA Association accounting.

Another great accounting software for societies is Quickbooks.

The program has been around for a long time and is known for its reliability, accuracy and wide range of features. It can be used to generate invoices, pay bills, track payments, manage accounts and more. An added bonus is that Quickbooks integrates with multiple other software programs, allowing users to easily manage their finances across multiple platforms. Well, ADDABooks is one of the best Quickbooks alternative to use.

Next on our list is Xero.

This software is intuitive, easy to use and can be used to keep track of all income and expenses. Additionally, Xero includes an online accountancy feature that is especially helpful for end-of-year accounts and tax returns. Xero can also be used to generate forecasts, as well as useful financial management and reporting tools.

The fourth product in our list is Wave.

It is free accounting software that offers all of the features a society needs. It can be used to generate invoices, manage payments, track income and expenses, manage payroll and more. Wave also offers advanced features like double-entry accounting and the ability to link to banking accounts for easy reconciliation.

Fifth on our list is Sage 50 Accounting.

It is a cost-effective and comprehensive accounting solution designed with societies in mind. It is packed with features including invoicing, payroll and expenses management, bank reconciliation, and financial reporting. Additionally, Sage 50 comes with a great set of customer support options for any questions you might have.

Number six is Kashoo.

It is cloud-based accounting software that offers great features that are tailored to societies such as invoices, expense reports, project tracking and more. Kashoo also has helpful mobile apps that make it easy to manage finances on the go. It is an excellent choice for societies who need an easy-to-use, yet powerful accounting solution.

Seventh on our list is Zoho Books.

It is an online accounting software that offers a lot of features to help societies streamline their financial operations. It includes invoicing, online payments, automated bank reconciliation and financial reports. Additionally, Zoho Books includes integration with a variety of other business applications, such as CRM and inventory management.

Eighth on our list is MYOB Accounting.

It is a popular accounting solution for societies and has been specifically designed to make the financial operations of a society easier. MYOB Accounting offers features such as automated bank reconciliation, accounts receivable, accounts payable and financial reporting. Additionally, it includes compliance features for taxes, superannuation and payroll.

Number nine is TaxAct.

It is designed to help societies prepare their annual tax returns and is packed with features to make tax time easier.

Conclusion

Organizations of all sizes can benefit from using society accounting software. It provides an easy-to-use and comprehensive solution to tracking and managing the financial information of an organization. In addition, the software can help organizations stay within their budget and adhere to any applicable laws and regulations. With the help of society accounting software, organizations can stay organized, efficient, and compliant.